Does Your Insurance Policy Predict Injuries Before They Happen? We Can, With Predictive Analytics.

by Kristopher Mizel

Insurance premiums are most affected by the losses a company has experienced. By glancing into the past, we attempt to foresee what tomorrow will bring. But is looking in your rearview mirror the best way to get around? What if your insurance company could predict losses based off newer, more accurate data? But predictive analytics isn’t a new conversation piece, Safety Professionals have been striving to look for correlations in data and unsafe behaviors for more than 100 years. But up until this point, the data available to our experts just wasn’t enough. Loss runs from the past 5 years, a few internal assessments, and some management understanding was most of what was available as far as safety data-streams. We have detected ergonomic events in the 10s of thousands from analyzing only a few hundred hours of video from a client. This results in orders of magnitude more data available to analyze.

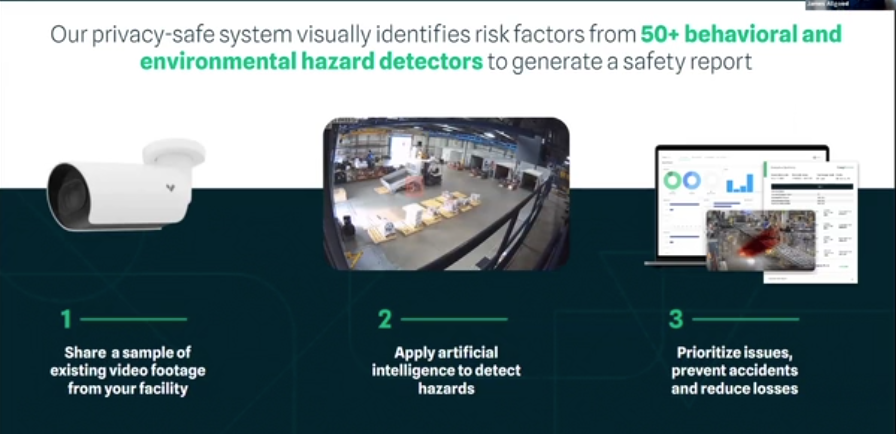

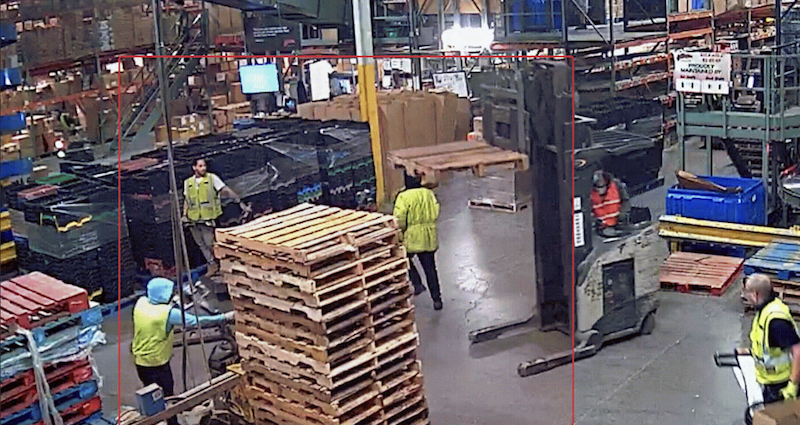

CompScience is implementing groundbreaking computer science technology paired with preexisting camera systems inside our client’s facilities, to make expert recommendations on corrective actions. This leads our clients to lower losses and more stable insurance costs. Our AI can identify and analyze a plethora of human and machine detectors ranging from unsafe body positions or lifting technique, to even forklifts and other Powered industrial Truck (PIT) hazards. All these new detections are used to predict future accidents based on current, real-world hazards, rather than records of accidents years past.

CompScience provides you and your team the valuable information that has not beencollected before now. Arming your loss control team with everything they need to identify and mitigate hazards before they turn into accidents. Near misses, historically a difficult event to quantify or even capture, now becomes a very useful source of close-calls that may directly relate to real-world incidents. Our AI will search the video footage and pull our video clips of each near miss detected. These events that would typically go unnoticed area now available for investigation.

What we can then offer directly to the client’s loss control team, is astronomically more information to base their research and recommendations on. Live risk report reviews with our team also allows for you and your team to talk to the experts reviewing your data and making recommendations. Our partnership leads to lower WC losses and increase client education. We ask the questions others don’t.